If you want to know how consumers are spending their money online during the Covid-19 pandemic, there is now a tool that can help you with that.

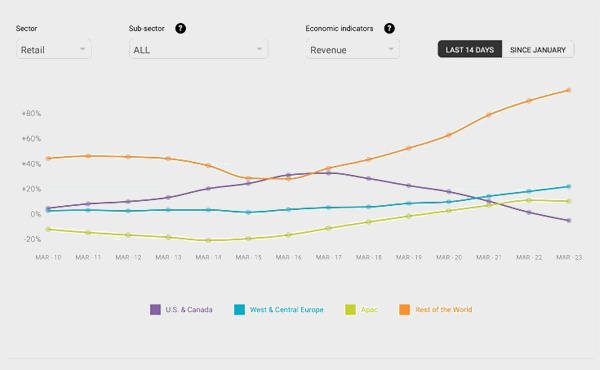

The new Covid-19 Commerce Insight (ccinsight) project draws on activity from more than a billion engagements and 400 million transactions in 120 countries, providing global and regional insights into ecommerce activity and trends.

Key insights from the new platform include how the pandemic is affecting the number of online consumer transactions, order numbers, the average order value, types of items purchased and more in context of the extraordinary measures taken by governments globally.

ccinsight currently derives anonymous data and technology from customer engagement platform Emarsys and data analytics provider GoodData.

“This pandemic is having an unprecedented effect on the global economy and consumer spending,” says Hagai Hartman, founder and chief innovation officer at Emarsys.

“And in the absence of hard data about consumer spending and confidence associated fear and uncertainty is self-perpetuating. We’ve launched ccinsight with the goal of putting up-to-date consumer data in the hands of business owners, economists and policy makers to help them by giving them the actionable insight they need to navigate this economic crisis.”

So far, many Covid-19 trackers only focus on the medical side of the pandemic and there have been few publicly available data sources analysing consumer spending and how it’s affecting global markets. ccinsight fills the market need to understand consumer buying behaviour, one of the leading indicators of economic health.

“It’s for this reason that we’re also calling upon any businesses that could help shine a light on the impact of coronavirus and inform future predictions for ecommerce. If you’re a data-driven business who is open to collaboration, please do get in touch to help improve and expand the ccinsight project.”

Recent Aussie stats include:

Home and leisure

• Ecommerce more than doubled growth rate since middle of march from c14 per cent YOY to over 50 per cent YOY

• Retail doubled growth since middle of March from c34 per cent YOY to over 70 per cent YOY

Fashion and accessories

• Ecommerce more than doubled growth rate since middle of march from c7 per cent YOY to 40 per cent YOY

• Retail increased growth rate since middle of march from -9 per cent YOY to over +60 per cent YOY, which suggests the ecommerce market for clothing is less well developed than other areas in the world and physical sales are shifting to digital as Australians are no longer able to go to stores.